Welcome to the exciting world of financial success! As a young adult, your financial habits today will shape your future tomorrow. By adopting smart money habits early on, you can set yourself up for a lifetime of financial well-being. In this article, we will explore five key habits that can help you pave the way to financial success. Get ready to take control of your finances and embark on a journey towards a brighter future!

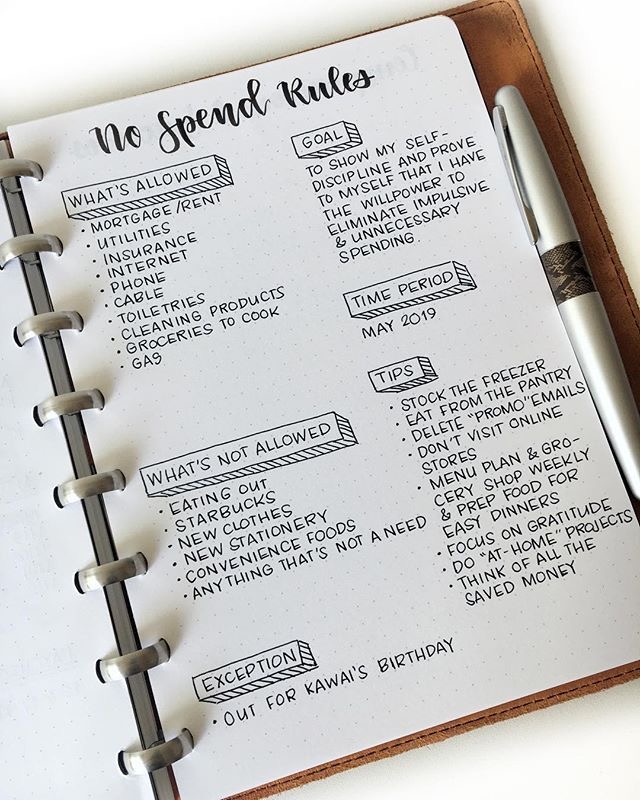

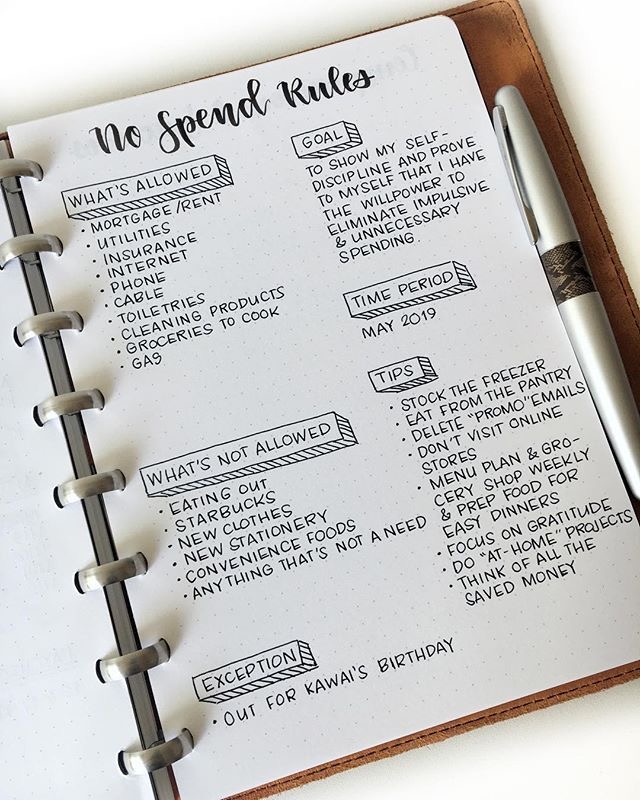

1. Budgeting

Creating a budget is the first step towards mastering your finances. Start by tracking your income and expenses, and allocate your money wisely. Understand where your money is going and identify areas where you can cut back or save. By budgeting effectively, you’ll have a clear roadmap for your financial goals and avoid unnecessary debt.

2. Embrace the Power of Saving

Saving money might not sound exciting, but trust me, it’s a game changer! Set aside a portion of your income for emergencies and future goals. Start small and gradually increase your savings rate. Consider opening a high-yield savings account or exploring investment options that align with your risk appetite. Remember, even the tiniest savings can grow into something significant over time.

3. Crush Your Debt with a Plan

Debt can be a burden, but with a strategic plan, you can overcome it. Prioritize paying off high-interest debts, such as credit cards or loans, as soon as possible. Avoid unnecessary debt by differentiating between wants and needs. Seek professional advice if needed, and explore debt consolidation or negotiation options. By tackling your debt head-on, you’ll free up your finances for more meaningful pursuits.

4. Invest Early for Long-Term Wealth

Investing may seem intimidating, but it’s an essential habit for building long-term wealth. Educate yourself on different investment options like stocks, bonds, or mutual funds. Start by investing small amounts regularly and take advantage of compound interest. Consider diversifying your portfolio to manage risk. Time is your greatest asset, so the earlier you start investing, the greater your potential returns.

5. Cultivate Financial Literacy

Knowledge is power, especially when it comes to personal finance. Invest time in expanding your financial literacy through books, podcasts, or online resources. Understand basic financial concepts like interest rates, inflation, and taxes. Equip yourself with knowledge about investing, budgeting, and building credit. By becoming financially literate, you’ll be better equipped to make informed decisions and avoid common financial pitfalls.

Fellow Gen Z, you have the opportunity to lay the foundation for a financially secure future. By adopting these smart money habits of budgeting, saving, managing debt, investing, and cultivating financial literacy, you’ll be well on your way to financial success. Remember, consistency and discipline are key. Embrace the journey, make smart choices, and watch your wealth grow. Your financial success starts today!

Leave a Comment